The Housing Crisis

Where we are and where we’re headed when it comes to affordability

Analysis of the region’s housing market validates what increasing numbers of area residents have been living. Inadequate entry-level housing supply and escalating prices at all levels threatens the American Dream and with it the long-standing means of wealth creation and key drivers of quality of life.

The broader implications of the emerging housing crisis include increasing costs to government and adding to the stress placed on non-profits already overburdened with meeting social service demands. Affordable housing represents as much an economic imperative as it is a moral one.

Rhonza

Kenneth

Donya

Anesu

Robert

What is ‘affordable’?

The term “affordability” is used in the context of ability to pay, making housing affordability the relationship between house prices and incomes.

- Affordable housing is generally defined as housing on which the occupant is paying no more than 30 percent of gross income for housing costs, including utilities.

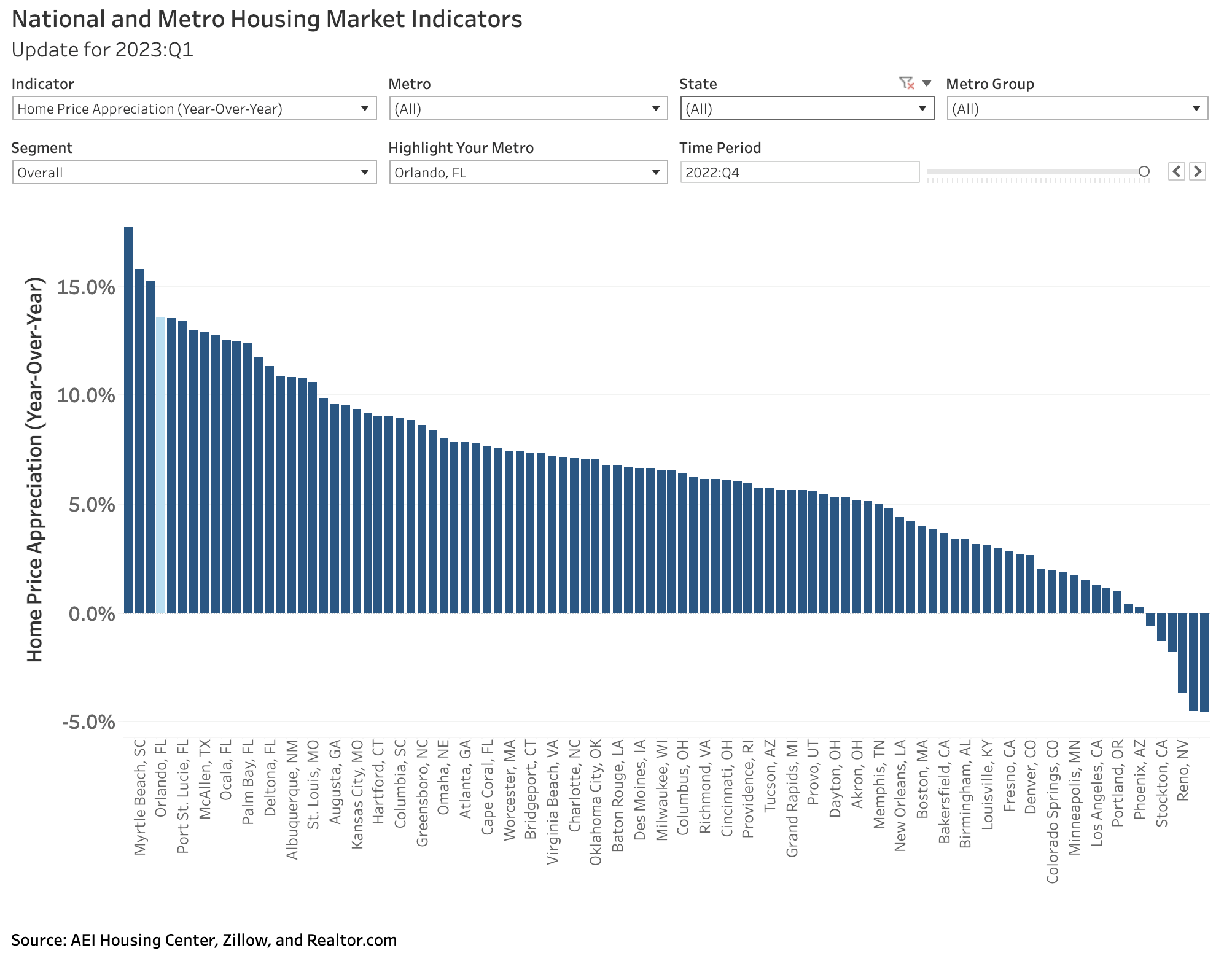

What is the data saying?

In the Orlando metropolitan statistical area (MSA):

- 1 in 4 homes sold during the second quarter of 2022 were considered “affordable”.

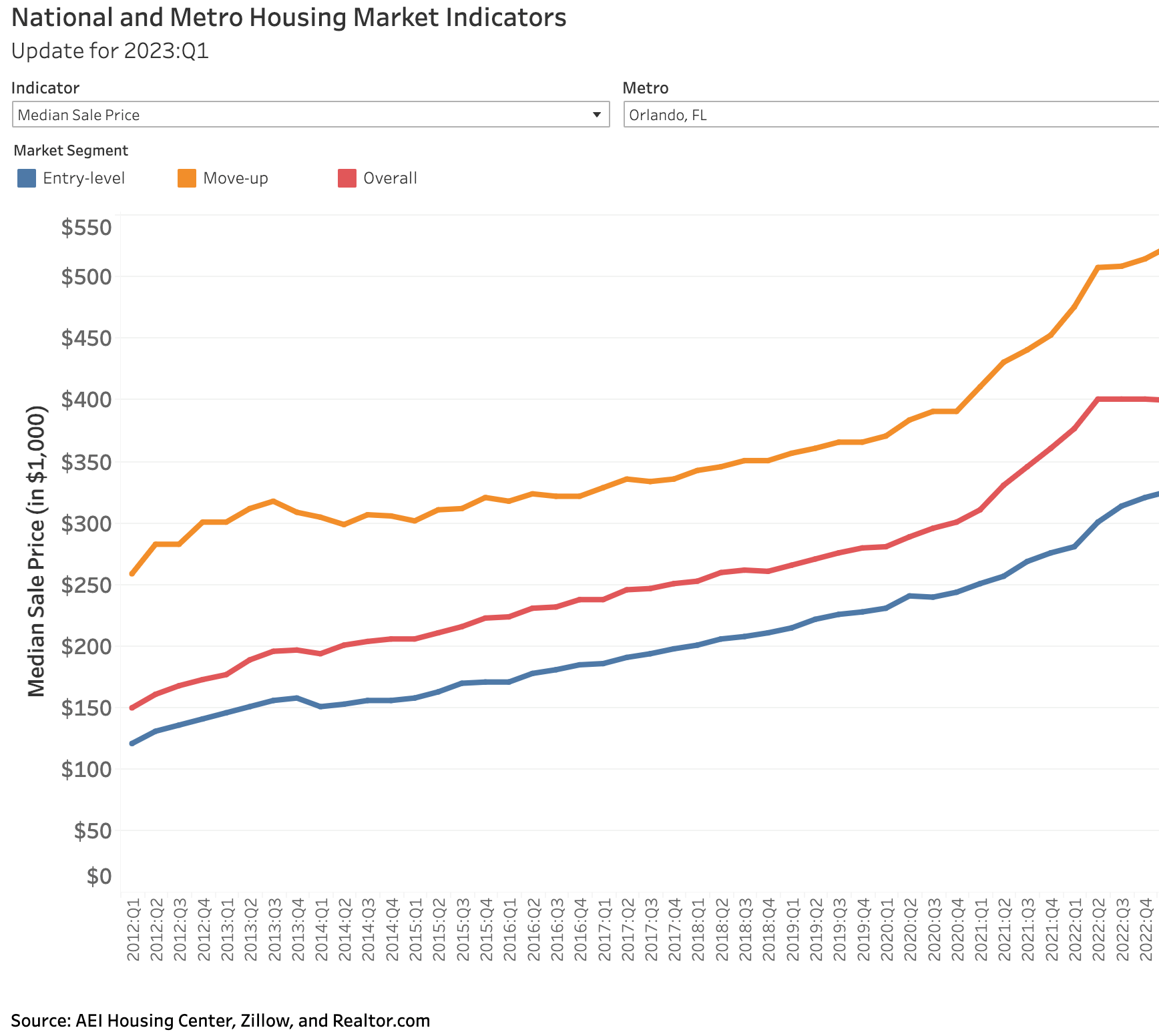

- Prices up 200% – Home prices increased by 200% between January 2012 and January 2023.

- $316,000 – The median sale price for an “entry-level” house increased from $140,000 to $316,000 in the 10 years between 2012 and 2022. NOTE: Median entry-level sales prices continued to increase through 1Q2023 to $325,000.

- House price appreciation (HPA) from a year ago increased at twice the rate of the nation: 13.6% and 13.4% for both the overall market and entry-level housing vs. 6.1% and 6.5% for the nation.

Sources: American Enterprise Institute. (Accessed August 2023) and NAHB/Wells Fargo Housing Affordability Index (Accessed August 2023)

Who can’t afford entry-level housing?

Let’s look at three of our community’s largest industries: health services, hospitality and education.

House price to income ratio calculations underscore what applications for our programs and services have revealed: It’s probably not who you think.

Analysis of occupational data exposes the precarious position of wage earners across a spectrum of industries and occupations.

Health Services

- Of workers in occupations in the area’s health services industry, over 9 out of 10 (92%) households with single wage earners making the median wage for their job cannot afford median-priced, entry-level home in the Orlando MSA.

- Over 1 in 2 (59%) dual-earning households with one employed in the health services industry making the median wage for their job and the other making $25.89/hour (estimated regional average wage in 2022) cannot afford a median-priced, entry-level home in the Orlando MSA.

The occupations include, among others:- EMTs

- Eye Lab Technicians

- Health Technologists and Technicians

- Medical Equipment Preparers

- Nursing Assistants

- Pharmacy Technicians

- Phlebotomists

- Psychiatric Technicians

- Rehabilitation Counselors

- Social and Human Service Assistants

- Surgical Assistants

Percentage of health workers making the median wage for their job who CAN’T afford the median-priced, entry-level house ↓

%

single-wage earners

%

dual-earning households

Hospitality / Tourism

- Of workers in occupations in Orlando’s hospitality/tourism industry, 99% of single-earning households making the median wage for their job cannot afford a median-priced, entry-level home in the Orlando MSA.

- More than 4 out of 5 (82%) of dual-earning households with one employed in the hospitality/tourism industry and the other making $25.89/hour (estimated regional average wage in 2022) cannot afford a top-tier, entry-level home in the Orlando MSA.Key occupations in single-earner households who cannot afford the median-priced, entry-level home:

- Chefs and Head Cooks

- First-Line Supervisors of Mechanics, Installers, and Repairers

- General and operations managers

- Meeting, Convention, and Event Planners

Key occupations in dual-earner households who cannot afford the median-priced, entry-level home:

- First-Line Supervisors of Entertainment and Recreation Workers

- First-Line Supervisors of Food Prep and Serving Workers

- First-Line Supervisors of Housekeeping and Janitorial Workers

- Maintenance and Repair Workers

Percentage of hospitality/tourism workers making the median wage for their job who CAN’T afford the median-priced, entry-level house ↓

%

single-wage earners

%

dual-earning households

Education / Training

- Of workers in occupations in Orlando’s local education and training industry, 100% of single employees making the median wage for their job cannot afford a median-priced, entry-level home) in the Orlando MSA.

- Almost 3 in 4 (69%) of dual-earning households with one employed in the local education and training industry and the other making $25.89 (estimated regional average wage in 2022) cannot afford a median-priced, entry-level home in the Orlando MSA.

Key occupations in single-earner households who CAN NOT afford the top-tier, entry-level home:- Elementary School Teachers

- Educational, Guidance, and Career Counselors and Advisors

- Secondary School Teachers

- Special Education Teachers, Kindergarten and Elementary School

Key occupations in dual-earner households who CAN NOT afford the top-tier, entry-level home:

- Bus Drivers

- Janitors and Cleaners

- Secretaries and Administrative Assistants

- Teaching Assistants

Percentage of education/training workers making the median wage for their job who CAN’T afford the median-priced, entry-level house ↓

%

single-wage earners

%

dual-earning households

%

single-wage earners

%

dual-earning households

%

single-wage earners

%

dual-earning households

%

single-wage earners

%

dual-earning households

Source: Internal analysis based on median wage data for Orlando industries compared to the cost of an entry-level home in Orlando. Home price-to-income ratio set at 3.0 and the average hourly wage for all of Orlando set to $25.89 for 2022. Data sourced from Lightcast and the American Enterprise Institute’s National and Metro Housing Market Indicators dashboard.

Renting Alternative

Renting presents little relief.

According to the National Low-Income Housing Corporation (NLIHC):

$64,640

Annual income needed to afford a two-bedroom apartment in the Orlando MSA ($31.08 per hour).

$82,560

Annual income needed to afford a three-bedroom apartment ($39.69 per hour).

19%

Increase in the cost of rent in Orlando in the last year alone, the highest in the nation.

7,000+

# of affordable rental units expected to leave the Central Florida market. These were made possible through the low-income housing tax credit program of 1986 and will no longer be constrained to affordability provisions of the program. It’s reasonable to expect these units will move to the full market rates.

Implications

The cost of housing is pushing the area’s workforce further from jobs with effects reverberating throughout the economy.

The surrounding five counties contribute 165,560 net commuters in Orange County.

Complex interactions within the economy tied to housing also pose a myriad of threats to regional competitiveness and quality of life:

- Constrained Talent Supply with Productivity and Quality Loss: Workers pushed further from job centers undermine overall availability and stability to employers. Employee shortages create capacity issues, requiring fewer workers to handle higher volumes that create delays and increase probabilities of error.

- Cost of Living Increases: Orlando, which once enjoyed a lower cost of living index, is now nearly 2% higher than the national average.

Let’s work together to Face The Housing Crisis™

We’re looking for at least 812 people – to represent each Orange & Osceola neighborhood – to raise their hand to address this crisis.